Executing and Financing a Roll Up

Posted on: July 24th, 2018

Roll ups are an aggressive growth strategy that we are seeing more and more from mid-market businesses. What exactly is a roll up? The phrase refers to a growth blueprint involving a series of planned, strategic acquisitions over a multiyear time frame.

These are especially suited towards industries with centralized operations, such as technology, because they allow for regional expansion without much change in operations.

When a company thinks about executing a roll up, they must be selective in choosing their targets. When you acquire another company, you want to look for a situation where 1+1=3.

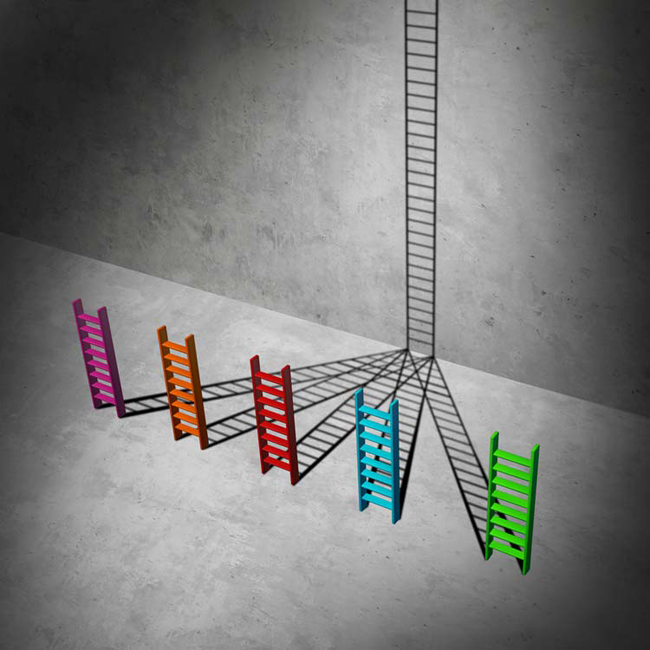

When two business have complementary attributes, the whole is greater than the sum of the parts. We see this phenomenon in action all the time in sporting events.

A less talented basketball team can easily beat a more talented team if the less talented team plays as one unit rather than as five individuals. Businesses merging is not so conceptually different from players merging to make a team.

Some businesses, when put together, are transformed for the better and operate more profitably than their two parts combined. Other times, when businesses merge they can actually detract value from the two companies.

It is important to ensure that your first acquisition in a roll-up is a strong one, and can function as a keystone acquisition for the subsequent acquisitions. If the first acquisition has a good team and good systems, it will be far easier to integrate subsequent acquisitions.

The key to achieving a positive transformation is look for compatible businesses that have overlapping strengths. If you want to diversify your product line, look for a company with different products that complement your current ones.

If you want to expand regionally, you want to find a similar business to your own, that operates in another region with an established customer base. If you are seeking more vertical integration or a large distribution channel, find companies that will address this need.

Roll ups are an effective way to grow fast while mitigating risk. As your EBITDA increases throughout the roll-up, the combined company qualifies for a higher EBITDA multiple upon exit.

Increasing in size will increase your company’s value. Roll ups require capital to drive so your lender is the most strategically important vendor you have in execution of your roll up.

It’s crucial for companies to find a cash flow based lender. This will give you a flexible financing structure so that you can have money when you need to close another acquisition.

Cash flow lenders are more likely to lend money for additional acquisitions because they see and buy into your end vision. Unlike other lenders, they want to lend to help your scale up and are not solely concerned with receiving their money back.

Look for patience, flexibility, and sensibility in your cash flow lender.