Mezzanine Debt is provided by independent funds, on EBITDA multiple basis. It stands behind the senior debt. It is unsecured by assets and does not require a personal guarantee. This layer carries significantly more risk than senior debt. It is generally priced at 20% per annum. The mezzanine provider charges interest of approximately 12% per annum and takes a small equity warrant in the business ranging from 5% to 20%. The standard mezzanine debt multiple is 4 to 4.5 times EBITDA. Mezzanine Financing is long-term money. They usually require only interest payments with no principal payments for the first 3 to 4 years. Most mezzanine debt loans mature in 5 to 7 years. Because mezzanine lenders own a small piece of the business, they tend to share the same risk reward profile as the business owner. It is in their own interest to promote growth of the business.

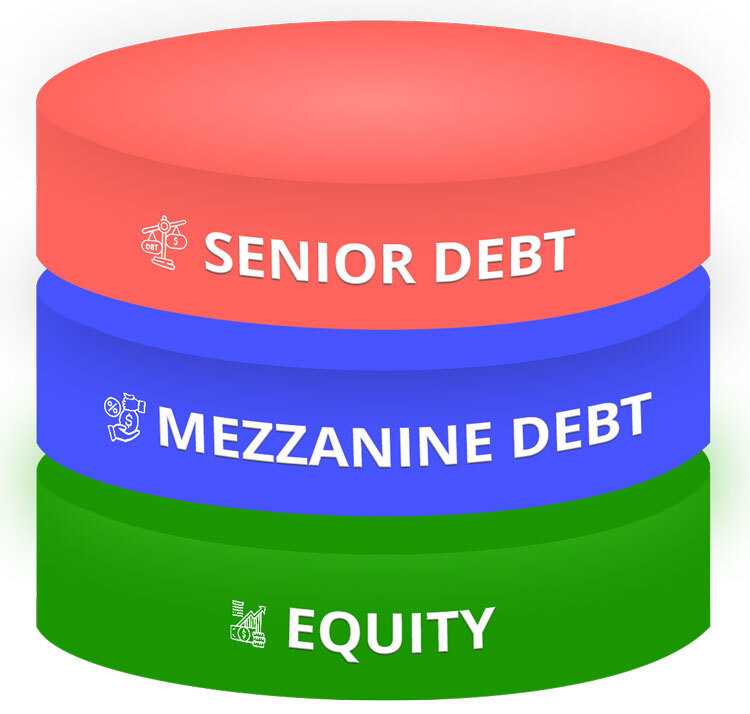

Mezzanine financing is a hybrid form of capital with features of both debt and equity. Mezzanine debt is generally structured as 6 years in maturity with interest only for the first three years. It ranks junior to senior bank debt. It carries an interest rate of approximately 12%. Mezzanine lenders target companies that are well established and are consistently profitable. Typically, these companies have strong cash flow but are not bankable due to a lack of hard assets. Mezzanine debt, when properly used, can provide all the capital needed to fund an acquisition, or buy-out. In this regard it can be viewed as acquisition debt. A business’ mezzanine debt capacity is easy to define and can make a world of difference in terms of ownership dilution.

Attract Capital is an expert in measuring any company’s mezzanine debt capacity. Regardless of the type of business, its revenue size ($10 million to $100 million) or financial trend (strong, flat, uneven) – we bring life to a business’ mezzanine debt potential. Through creating this possibility of mezzanine debt financing, we greatly expand our client’s access to capital.

Whether it is used as acquisition debt, growth capital funding, bank refinancing, or owner buy-out, mezzanine financing will deliver a peak outcome. Mezzanine financing is flexible, long-term capital that can accelerate corporate growth and build long-term value.

Contact us today for a free consultation for your mezzanine financing needs.

FAQ’s on Mezzanine Debt

You receive a much larger sized loan than a bank loan. This gives you more capital for your acquisition or growth.

There is no personal guarantee which means the lender is taking the same risk as you are.

Mezzanine debt does not require immediate principal repayment. Only interest payments are due for the first several years.

It can take the place of equity in a deal, and help you hold on to more of your shares.

Generally, companies with revenue greater than $20 million and EBITDA greater than $2 million, post-acquisition on a combined basis.

Mezzanine loan size requested should be a minimum of $3 million and can goall the way up to $100 million.

The total debt including mezzanine and existing loans should be less than 3.5times pro forma EBITDA.

Companies such as technology, business services, healthcare, manufacturing,distribution and consumer products are all eligible.

Real estate, start up, and commodity products are generally not eligible.

Independent sponsor acquisitions where the mezzanine debt supplements the buyer’s equity investment.

Expansion and growth financing, where the bank is reluctant to lend.

Business acquisitions where there is rollover equity but no new cash equity coming in.

Acquisition roll-ups where several deals will need to be funded.

Pricing is usually 10% current pay interest, 2% deferred interest and a small 1to 2% yield enhancement.

The yield enhancement usually brings the total return to 13% to 15% all in.

The prospective borrower also reimburses the lender for legal and due diligence costs.

Term sheets are usually received within 14 days of launch of the deal in the market.

Due diligence usually starts within 30 days of launch.

The closing usually occurs within 60 to 75 days.

Strong historical and projected cash flow.

Companies with strong market position with healthy gross margins (>30%).

Talented management team with ownership in the business.

Recession resistant, non-cyclical industry.