A Tapestry Framework for Mezzanine Debt Raises

Posted on: June 23rd, 2023

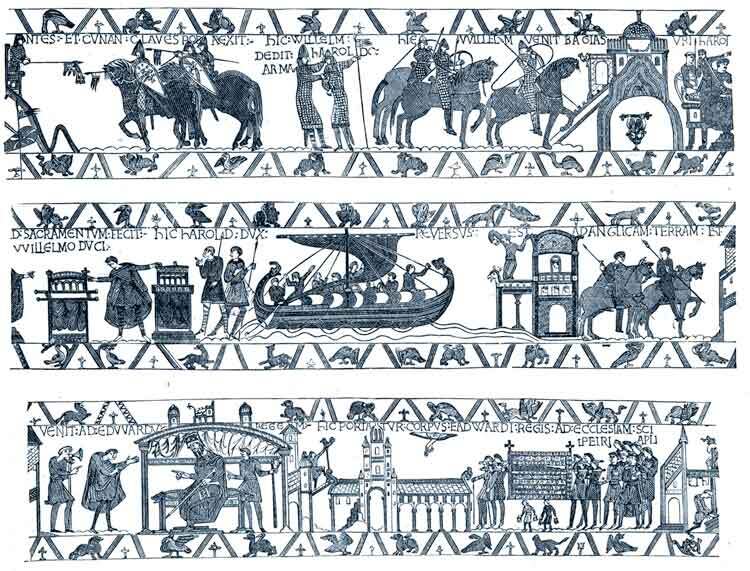

Throughout history long before the emergence of the mezzanine debt market, tapestries were used as a mass media to communicate a visual story to a largely illiterate citizenry. A notable example is the Bayeux Tapestry created in the 11th century from the Normandy region of France. It tells the story of the Norman Conquest through 58 frames entirely through visual images. The tapestry tells a very clear story of the events involving Harold the II and William the Conqueror that led to the Norman Conquest. The 58 frames perfectly convey the story with little ambiguity to the viewer.

One needs only to walk slowly past the tapestry to grasp the plot and meaning, without having to exert much mental energy. This basic communication standard, of getting the point across using simple methods, has become a lost art form to investment bankers in the mezzanine debt sector. Whereas the Bayeux Tapestry had to use images to be understood, investment bankers mysteriously underutilize the written medium in today’s market to raise mezzanine debt. Despite the fact that the written word is universally understood and easily grasped, these mezzanine debt presentations have become indecipherable collections of graphs and bulleted phrases. These image heavy PowerPoints fail to impress mezzanine debt lenders for several reasons.

Often, they fail to cover the basics needed to understand the business. Every CIM should cover basic areas of the business model such as its products, customers, sales and operations. Rather than state this in simple prose format, overly complex slides make it harder for the mezzanine debt lender to comprehend. Often, they use overly general slides that trumpet the greatness of the company without logically explaining the layers of specialization and strengths that make it great. PowerPoint presentations also lack assistive narrative structure which means the reader is left to their own interpretation of the graphs on the page. If the mezzanine debt lender misinterprets the slide, this can lead to misunderstanding the fundamentals of the business.

Finally, all good mezzanine debt deals need a strong growth story which the written word is best suited to convey. This allows for deployment of business model analogies and helpful context to reinforce understanding. A written word CIM is the best communication medium to argue a company’s mezzanine debt-worthiness. A disciplined written document has a captivating, tapestry-like effect on the mezzanine debt lenders of today in search of business model and growth story clarity.