Achieving Roll-up Greatness with Mezzanine Debt

Posted on: July 29th, 2021

Mezzanine debt is a transformative form of growth capital, that can power a Company’s scale-up from small business to large enterprise. Prized for its flexibility and wide use cases, mezzanine debt can accelerate your growth journey and transport your business safely to the top of a growth opportunity.

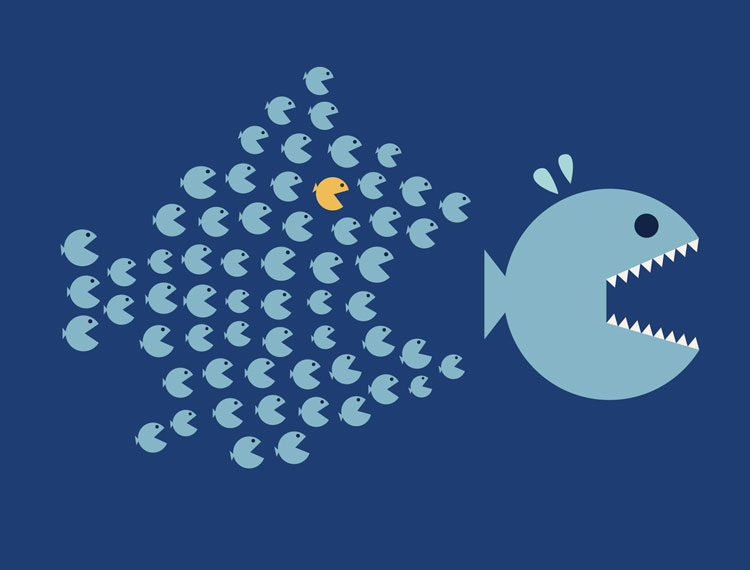

Most aspiring companies with expansive visions are stocked with new products and sales channel strategies. They lack financial resources to build enough mass to take advantage of their market opportunity whether through an acquisition or strategic investment. Mezzanine debt borrowing is a controlled and reliable method of funding that ensures the safe passage of the business during this transitory growth state. It allows for growth acceleration without dictating hyper levels of growth. It allows for underlying value appreciation without dictating artificial exit events.

Mezzanine Debt Funding Philosophy

The mezzanine debt funding philosophy is based on financial analysis, business pragmatism, and relationships. Most mezzanine debt lenders are seasoned financial executives and have mature credit judgement. They are looking to partner in an inobtrusive way, allowing the entrepreneur wide berth as to operational control and strategic decisions. Using mezzanine debt as an equity substitute is a compelling approach to building value.

If your company has pre-existing value and needs capital, a mezzanine lender can provide most of your finance need. This works well in a roll-up transaction where an acquirer does a series of acquisitions over a short period of time. If the company has some implied equity value to start and the acquisitions are at reasonable multiples, mezzanine debt can provide non-dilutive acquisition financing in lieu of equity.

By using mezzanine debt instead of expensive equity, all the increased value belongs to you, the current owner, instead of sharing it with an equity investor. The most successful roll-ups are deals that start with a small amount of equity and leverage their incremental EBITDA debt capacity to fund successive deals through mezzanine debt. When a business grows from $1 million in EBITDA to $10 million in EBITDA via mezzanine debt funded acquisitions, the equity value can increase over 20-fold. Through mezzanine debt, roll-up greatness is possible.