Building Scale up Strength into your Acquisition Financing

Posted on: May 15th, 2021

Acquisition financing has a coveted place in the middle market. It is an intensely sought form of capital, and is usually allocated to the strongest, most sensible deals in the market. These include independent sponsor acquisitions, private equity-back acquisitions, roll-ups, and all forms of buyouts. Often in the frenzy to raise acquisition financing, the buyer adopts a different persona, and weaves a lender-friendly growth story.

Most buyers have compelling reasons for an acquisition and usually have something unique in their background that gives then an advantage in growing the company. This can be sales channel access, product innovation expertise, or more efficient processes. All these strengths advantage the buyer as a leader of vision with a growth plan, that can do more with the business than the current owner.

Leaders that Acquisition Financing Lenders are keen on

Acquisition financing lenders are keenly focused on lending to these types of leaders, as they are battle tested and usually have higher level business judgement. Buyers usually understand, regardless of their pedigree, that growth is asynchronous, and depends on alignment of variables, many outsides of their control. Sometimes the product and sales resources are well positioned but market demand is soft. Other times, demand is off the charts, yet the supply chain is a struggle. Getting into the weeds on these growth scenarios is often beyond the scope of disclosure that buyers provide to their acquisition financing provider.

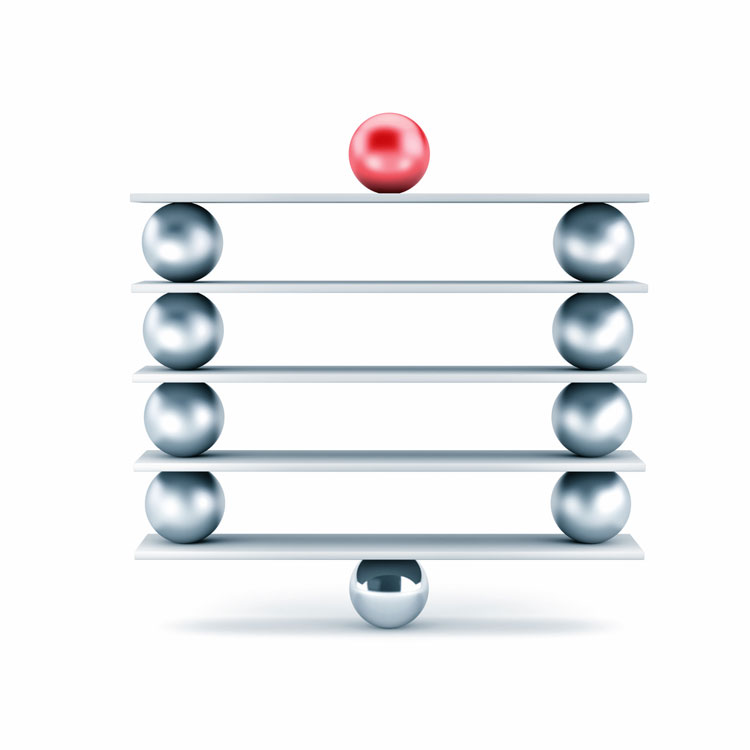

Instead, buyers often used generic frameworks to depict revenue growth such as unit-volume, revenue by customer, total contract value or market share in their financial projection. These are useful in presenting a relatable way for the acquisition financing lender to think about the scale-up. But ultimately, they present an overly optimistic picture of the underlying growth assumptions, as most of these are dependent on the internal resource readiness of the company.

History of Middle Market Acquisition Financing

In the history of middle market acquisition financing, growth success often has more to do with the breadth and depth of the organization’s resource base, than anything else. Companies that have a history of investing in their teams, systems, and processes strategically, are the ones with high scale-up potential. These businesses are the ones that acquisition financing lenders are most interested in financing. While a buyer cannot control all the market-scale up assumptions, he or she can focus on ensuring the company has the right resource base. This will derrick the deal in the eyes of the acquisition financing lender and position the company for long term growth success.