The key steps for a successful acquisition vary slightly from case to case. The general key steps for a successful acquisition, however, can be applied to almost every acquisition. It is important to have sound rationale and a good business plan when going forth with an acquisition. The first step would be to ask yourself what would be achieved by the acquisition.

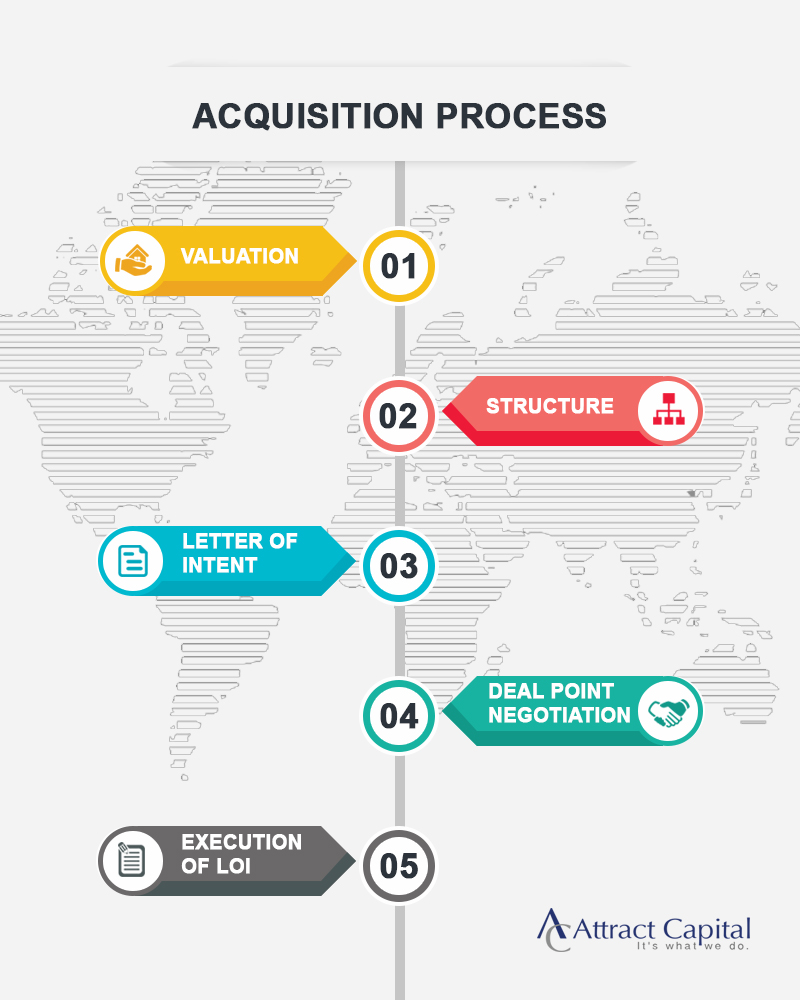

There are many good reasons for an acquisition including: an expansion of customer base, a fuller use of a supply chain, to increase your market share, and to eliminate competition. The second of the key steps for a successful acquisition is to list the steps it takes to go through with an acquisition. Next, you must analyze the type of deal that you are looking for.

Next it is important to do research on the industry and create a list of businesses that fit your ideal deal. Finding the right company at the right price is critical.

Another one of the key steps for a successful acquisition is to look into how acquiring the company will affect your company’s P&L and balance sheet. Create expected future projection tables for your company after the acquisition to see if the acquisition will be worth it for your company in the long run. Finally, the last of the key steps for a successful acquisition would be to develop a strategy for your acquisition.

The best way to insure that your acquisition be a successful one is to have a foolproof plan that covers every bit of information necessary. Sound planning and comprehensive integration are very important areas to address.Your company must be prepared to provide the lender with all information necessary about the company and the target company, and your company must be educated on the process of the acquisition. With these elements in mind, you now have a handy list of the key steps for a successful acquisition.