Mezzanine Debt – A Roll Up Power Play

Posted on: January 11th, 2022

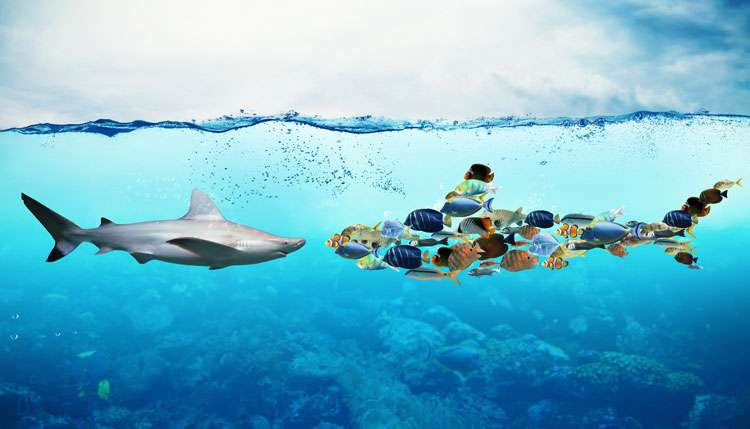

A roll-up acquisition strategy is a highly effective way to build a company, especially in a fragmented industry. The dynamic nature of the acquisition program makes mezzanine debt lenders a great resource for turbo-charged roll-ups. Roll-up entrepreneurs usually have a competitive edge they wish to expand and use acquisitions as a form of growth to achieve desired scale.

Mezzanine Debt for Acquisition Needs

Mezzanine debt provides cash flow-based structuring which fits their acquisition needs. Through rolling up, the operator builds scale faster and deploys their competitive edge over a larger enterprise. Whether using better technology, lower costs or more effective selling, roll-ups are dependent on having enough capital to acquire multiple small businesses to create a larger business. Mezzanine debt lenders provide a power play level of financing strength for roll-up operators for the following reasons:

- Funding speed – roll-ups occur at a rapid-fire pace and require a lender who can fund frequently in a friction-less fashion. Mezzanine debt lenders can move quickly after initial underwriting and often use a formula-based acquisition financing line for efficiency.

- Generous lending parameters – mezzanine debt lenders fund based on adjusted EBITDA meaning they fund based on future profit growth. Their loan sizes are usually 3 to 3.5 times adjusted EBITDA, providing a sizable amount of funding.

- Financing Optionality – mezzanine debt lenders want to provide additional capital to their borrowers from the outset. Many seek to double the size of their initial commitment. If the size of the deal gets too large, they are proactive about bringing in another lender to provide more dry powder.

- Understanding of Risk – mezzanine debt lenders understand the risks of acquisition integration and change management. Due to their experience with hundreds of portfolio companies, they have a lot of knowledge to pull from to help guide your investment thought process.

- Sole Source of Capital – if properly equity capitalized, the mezzanine debt lender can be a single source of capital for the entirety of the acquisition roll-up journey. This saves time and removes any intercreditor squabbling.