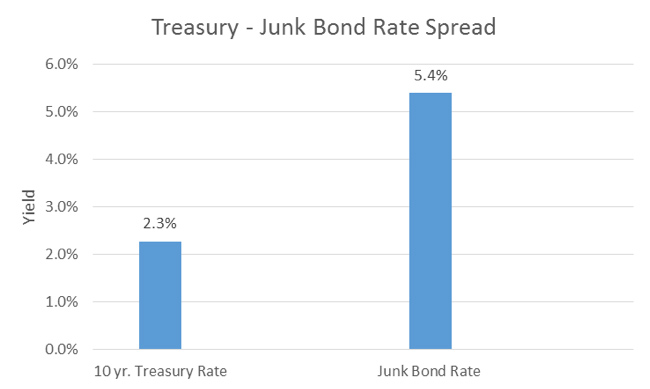

The current spread between 10-year treasuries and Junk Bonds is 310 basis points. This means that a bondholder receives 3.1% extra for holding junk bonds over 10 year US Treasuries. That is not a lot of extra return for the extra risk. This spread has been trending lower as junk bonds have increased in price. This current level is flashing a bit of a warning sign. Historically, junk bonds trade at a 5.5% spread above treasury rates. Lower spread reflects market complacency, the likes of which we saw before the Financial Crisis of ’08. Spreads got as low as 2.5% pre crisis and then rocketed up to 22% post crisis. Let’s hope we avoid that roller coaster and have a slow return to a higher spread, over time.