Timely Action and Trailing Twelve Month Covenant Alignment

Posted on: April 18th, 2023

Acquisition financing lenders are creative thinkers and routinely give acquirers credit for things that have yet to occur. In the world of acquisition financing accounting, companies are permitted to pull forward future cost savings and reflect them in their historical earnings on a pro forma basis. It is a bit like banking on future actions to justify paying a higher price today.

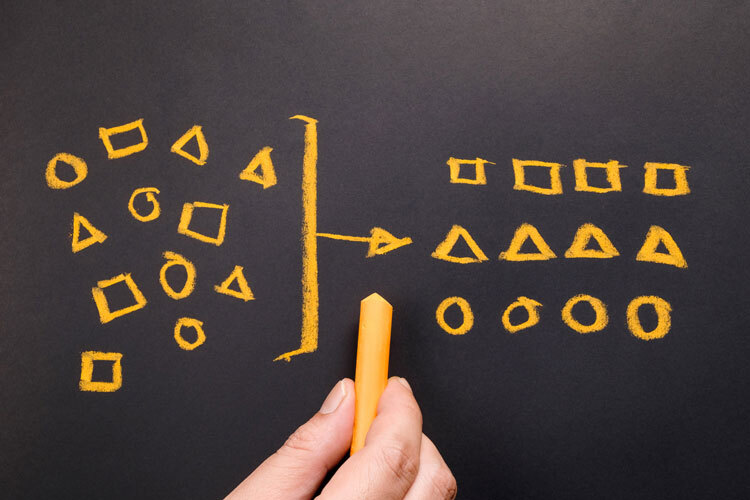

Often, acquirers need to identify these cost savings and reflect them in their current pro forma, to make the deal financeable. Many of these items are easy to capture yet some require significant work and focus to implement. When the deal closes and the transition to new ownership commences, often the timetable gets pushed back to operationalize these actions. When this happens, important cost savings not realized in a timely manner create a gap between the projected and actual performance in the future. Not only does this create a hole in projected EBITDA, but it creates concern on the part of the acquisition financing provider as to management’s credibility in delivering results. This situation creates a long-term repercussion for the covenant measurement of the borrower’s trailing twelve-month performance.

When you fail to capture cost savings in a timely manner, it creates historical twelve-month earnings drag which will result in lower historical EBITDA and covenant ratios. For example, if you had $1 million of unrealized cost savings included in pro forma EBITDA of $4 million, your leverage ratio denominator has declined a full 25% which is often enough to precipitate a covenant breach. For cost savings that unfold over time, a delay in realization decelerates earnings momentum and ultimately deleveraging. Timely action is a critical element to ensure proper earnings growth and covenant compliance, particularly during the early part of the loan term. When the deal flops out of the gate due to management inertia, it is challenging to regain operational credibility in the eyes of the acquisition financing lender.