Why You Need Mezzanine Debt in the Post-Covid-19 Period

Posted on: May 13th, 2020

Mezzanine debt is a durable form of middle market financing, based on a timeless set of foundational principles. It is a tailored solution, based on cash flow growth that funds transitional capital needs. Armed with a flexible structure and a patient maturity, mezzanine debt delivers large capital inflows which create long term growth waves. Mezzanine debt loans are structured as a multiple of forward EBITDA, and as such provide significant capital headroom for companies experiencing growth such as scale-ups and acquisitions.

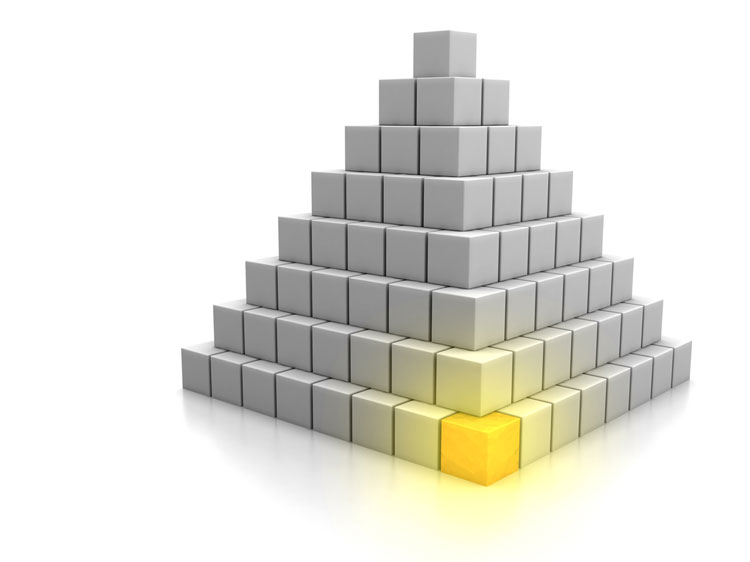

Mezzanine debt loans fund deeper in the capital structure, beyond the asset collateral and cover the hard to fill financing gap most companies face when transiting through a hyper growth phase. In many cases, mezzanine debt is often the difference between success and failure of a transaction. With it, you have all the capital needed to close and execute the growth plan. Without it, you have difficulty closing you deal and investing in growth.

Today, due to the economic shockwaves of Covid-19 many companies are struggling and need more capital to stabilize their balance sheets. Many businesses, particularly overleveraged ones, will not likely be able to emerge on the other side of the crisis. Once the business restart commences, it is unclear how quickly businesses will recover. Some will come roaring back; others will take longer.

As some businesses fall by the wayside, there will be opportunity to pick up large new pieces of business, and a large potential realignment of your business’ market share. Supplier chain dynamics will also play a role in how fast you can scale-up. Post crisis, supply chains may change and require relocation. Investment may be needed to set up a new supply chain or to an expand capacity at your existing one. You may also need to change your product line to reflect the new economic reality. This may involve redesigning existing products and setting up new customer service and delivery teams.

All these possible changes create a backdrop of uncertainty, and a need for sharp decisive management action. What is clear about the new environment is that your scale up will be hard to project and different than any other recovery. Strong capitalization and capital structure flexibility are critical to navigating this period. Given the number of knowable unknowable factors at play, companies need a large capital cushion and a flexible capital runway.

Mezzanine debt provides a number of unique benefits which facilitate this:

1. Long Term Focus – Mezzanine debt providers give you 5 to 6 years to repay the principal and allow you to pay only interest on the loan throughout the term. They are patient lenders that understand growth companies need time and space to fully mature.

2. Smart Sounding Board – Mezzanine debt lenders are savvy businesspeople who have been through tough periods. They can help you identify important growth drivers and decision points as you move forward.

3. Flexible Funding – They can provide you capital over several rounds for a variety of uses. They can fund organic and acquisition growth simultaneously, allowing you to grow at a faster rate.

4. Willing to Take Risk – Mezzanine lenders are in the business of taking risk and will not shy away from bold growth plans. They will fund into the future and place great faith in the management team.