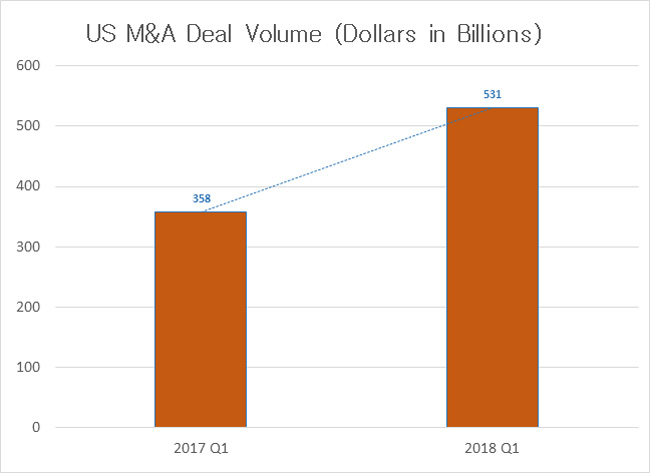

According to PwC’s Deal Blog, Q1 of 2018 displayed a strong showing for US M&A deal volume. M&A deal value was $531 billion in Q1 2018, about $175 billion greater than Q1 of 2017, a 48% increase. Although this statistic includes all M&A, PwC notes that “middle-market M&A carried much of the water.” Long-term economic expansion has been one of the main factors driving deal volume. Increased wages and lower tax rates have led to higher amounts of available capital; PE firms and venture capital funds have raised more than $1 trillion globally. The current business environment fosters a friendly environment going forward for middle market companies looking to grow through acquisitions. Low taxes and readily available capital make financing aggressive growth easier, a strong sign for mid-sized companies with aspirations to become bigger.